How NFTs are revolutionising the wine world

Non-fungible tokens are the latest trend in the wine world with more and more producers launching wines and spirits with digital added value. But how does it work, and what exactly do customers get out of it?

A price of $2.5million USD was paid for a magnum bottle of Château Avenue Foch from 2017 when it was auctioned last year. Don’t be surprised if you are unfamiliar with this Champagne producer, because the most expensive Champagne bottle in history to date is less about the sparkling contents than the whole shebang.

In this case, the container is key, i.e. the vessel itself. Illustrations of so-called ‘Bored Apes’ are printed on it; drawings of cartoon monkeys generated by an algorithm and executed by a computer. Behind this is the Bored Ape Yacht Club, one of several projects of an American company estimated to be worth four billion dollars. The business model behind the Bored Ape Yacht Club works in such a way that there are a total of 10,000 different Bored Ape monkey illustrations, all visually different from each other, which are sold to well-heeled interested parties (Madonna is said to own a ‘Bored Ape’, Justin Bieber and Gwyneth Paltrow likewise). So, the computer-generated drawings basically represent 10,000 unique digital works of art, sold in the form of NFTs – digital proofs of the uniqueness of the artworks (more on that later).

The $2.5million Champagne consists on the one hand of 1.5litres of French noble bubbly, and on the other the NFTs for the printed monkey illustrations that one buys at the same time (the prints on the bottle are no more than reproductions of these works of art, just as a poster of the Mona Lisa is only a reproduction of da Vinci’s original).

But it was deemed worth this sum to a pair of Italian investors, Giovanni and Piero Buono, who do not hide the fact that they only bought the Champagne for speculative reasons: “We do not intend to drink it, but hope that the bottle will increase in value.” The chances of this happening are not bad at all, because a real hype has developed in recent years around NFTs, the digital proofs of ownership for all kinds of goods, in which producers of fine wines and luxury spirits are now increasingly wanting to participate – just like the Champagne house Avenue Foch. However, the individual suppliers are taking very different approaches.

What are NFTs and tokens?

In order to better understand the growing importance of NFTs for the wine trade, the most important terms used should first be defined. Both NFTs and tokens originate from the world of cryptocurrencies, i.e. those purely digital assets that – mostly on the basis of decentralised databases distributed over many individual computers (blockchain technology) – primarily function as speculative objects, or money-like objects of exchange. Almost any digital capital or asset is referred to as a token. Some tokens can be exchanged at will on the internet or used to pay for services or goods because they always retain the same value. Such tokens are called fungible or exchangeable. On the digital side, bitcoins are among them; in analogue life, euros would also be called fungible because they are always worth the same amount – ten euros are ten euros, whether in a banknote or in ten one-euro coins.

Non-fungible tokens, or NFTs, on the other hand, are digital assets that are unique and therefore cannot be replaced by something of comparable value. In theory, of course, they can be bought with analogue money (as happened with the ‘Bored Ape’ Champagne) if the price is agreed upon – similar to a work of art or another object of sentimental value. But – to stay with the case of the $2.5million Champagne – even then you get nothing more than a bottle of sparkling wine (which ideally remains safely stored with the manufacturer until you sell it again, or perhaps open one day) and, here comes the NFT trick, a unique, non-duplicable code that serves as proof of ownership for the original digital artwork that adorns the bottle as a reproduction. Here we have the cartoon monkeys.

Where are NFTs traded?

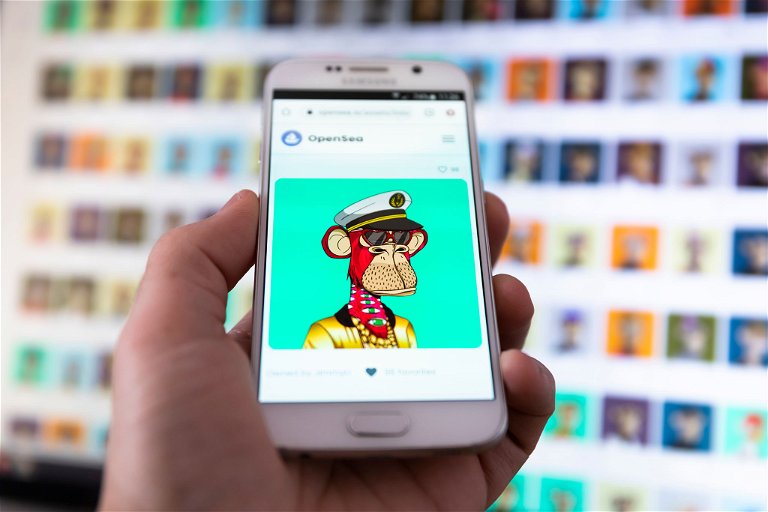

A NFT can thus be compared to a title deed that guarantees the authenticity and/or uniqueness of a physical or digital asset. If programmed in this way, it also includes all information about the previous owners, sales prices, etc. All this information is stored in a decentralised database chain (blockchain!) on countless computers around the world, which makes forgery or manipulation almost impossible. But because, basically, any internet user can create a NFT, a rare bottle of wine linked to it could still be counterfeit, for example, unless it is purchased directly from the manufacturer as a NFT. NFTs are traded on platforms such as opensea.io, and payment is primarily made with cryptocurrencies such as Ethereum or xDai.

The wine world discovers NFTs

So far, most wineries actively using NFTs have linked physical bottles with tokens, often together with digital art, following the successful NFTs from the art world. Dom Perignon, for example, launched a limited edition (100 each) of its 2019 and 2006 Rosé as NFTs in 2021 with singer Lady Gaga, each bottle accompanied by a digital animated version of the bottle. In the same year, Château Angélus created a NFT from an entire barrel of its Grand Vin 2020, including 3D artwork, which was sold for $100,000 USD. Penfolds also entered the business and offered a barrel of Magill Cellar 3 from 2021 as a NFT. It was sold within seconds for about €90,000, as Amanda Green, global digital director of the company, reports. According to her, the aim was to reach the target group of the so-called New Luxurians.

These New Luxurians love luxury brands, are digitally savvy, and are considered to be absolute trendsetters – young, financially-strong people who prefer to buy rare wines as NFT packages instead of purchasing them classically via subscriptions or the secondary market.

Danielle Barich, Web3 Development Director of Cognac brand Hennessy, also sees NFTs as a new way to connect brands and consumers. In the case of Hennessy, this is now also about special experiences that are made possible for consumers through the purchase of a NFT. For members of the NFT’s Friends With Benefits network, for example, Hennessy offered a special token that gave access to the opening event of Art Basel Miami, as well as the co-creation of a limited edition VSOP bottle with an artist, which again only NFT holders could purchase. Members of the NFT’s global wine club dVin, which was launched this May, also gain access not only to rare bottles but also to experiences that cannot otherwise be bought. Lifetime membership to dVin is limited to 4,000 people; the NFTs required for this are traded between $5,000 and $9,000 USD. As a member, you get exclusive access to private tastings and parties with top winemakers, but you can also participate in the first harvest of the Bhutan Wine Co. in the Himalayas.

Forgery-proof NFTs

On the blockbar.com platform, where mainly luxury wines and spirits are traded, most manufacturers explicitly advertise access to limited editions – a winning argument for wine and spirits’ collectors alike, especially with regard to the authenticity of the products. Moreover, the rare collector’s bottles are stored at blockbar.com under optimal conditions until the NFT is redeemed and the physical bottle is obtained.

The counterfeit protection is a big advantage according to Amanda Green of Penfolds, who said: “Counterfeits are a big problem in the luxury sector. As the blockchain allows anyone to trace the ownership and history of a product, we will continue to experiment in this area.”

With Swiss company vinID, in addition to the physical bottle, the customer purchases a digital twin of the wine as a NFT, which can be stored in a blockchain wallet, a digital wallet as it were. The wallet thus also serves as a wine archive in which notes about the wine can be recorded. “We have a NFC tag on the neck of each bottle, which – as soon as it is cut or removed – reports via a chip that the respective bottle has been opened,” reports Sebastian Schier, Managing Director of vinID. This also eliminates the possibility of criminally refilling an original bottle of a rare wine with a cheap alternative. Via the vinID app, consumers can also quickly access information about the wine with their smartphone by holding it up to the neck of the bottle. Producers can also get in touch with customers and inform them about new vintages, the optimal drinking maturity of a wine, and more via push messages.

The extent to which these and other possibilities offered by NFTs will establish themselves in the wine sector in the future, or pay off for investors, can only be guessed at, at present. On the one hand there is great enthusiasm, but on the other, some financial experts are already warning that NFTs could turn out to be a speculative bubble that will burst at some point. One will see.

NFT benefits

How customers benefit

- Forgery protection: NFTs can be compared to title deeds. Once purchased from the manufacturer, they are also a certificate of authenticity.

- Transparency: A NFT can contain any information about a product: previous owners, sales prices, production, or quantity. This allows for maximum transparency.

- Value enhancement: The majority of NFTs in the wine and spirits sector are rare collector’s items, which is why an increase in value can be expected.